Table Of Content

The loan does not require any down payment, and unlike other loans, it also does not require private mortgage insurance. Depending on your credit score, you may be qualified at a higher ratio, but generally, housing expenses shouldn’t exceed 28% of your monthly income. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals.

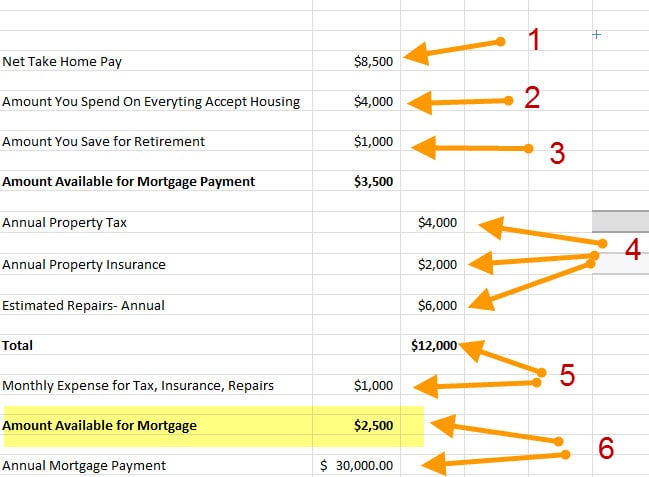

The 28/36 rule - what it is and how it works

The longer you can stay in a home, the easier it is to justify the expenses of closing costs and moving all your belongings — and the more equity you’ll be able to build. Interest rate - Estimate the interest rate on a new mortgage by checking Bankrate's mortgage rate tables for your area. Once you have a projected rate (your real-life rate may be different depending on your overall financial and credit picture), you can plug it into the calculator.

What is the difference between APR vs interest rate?

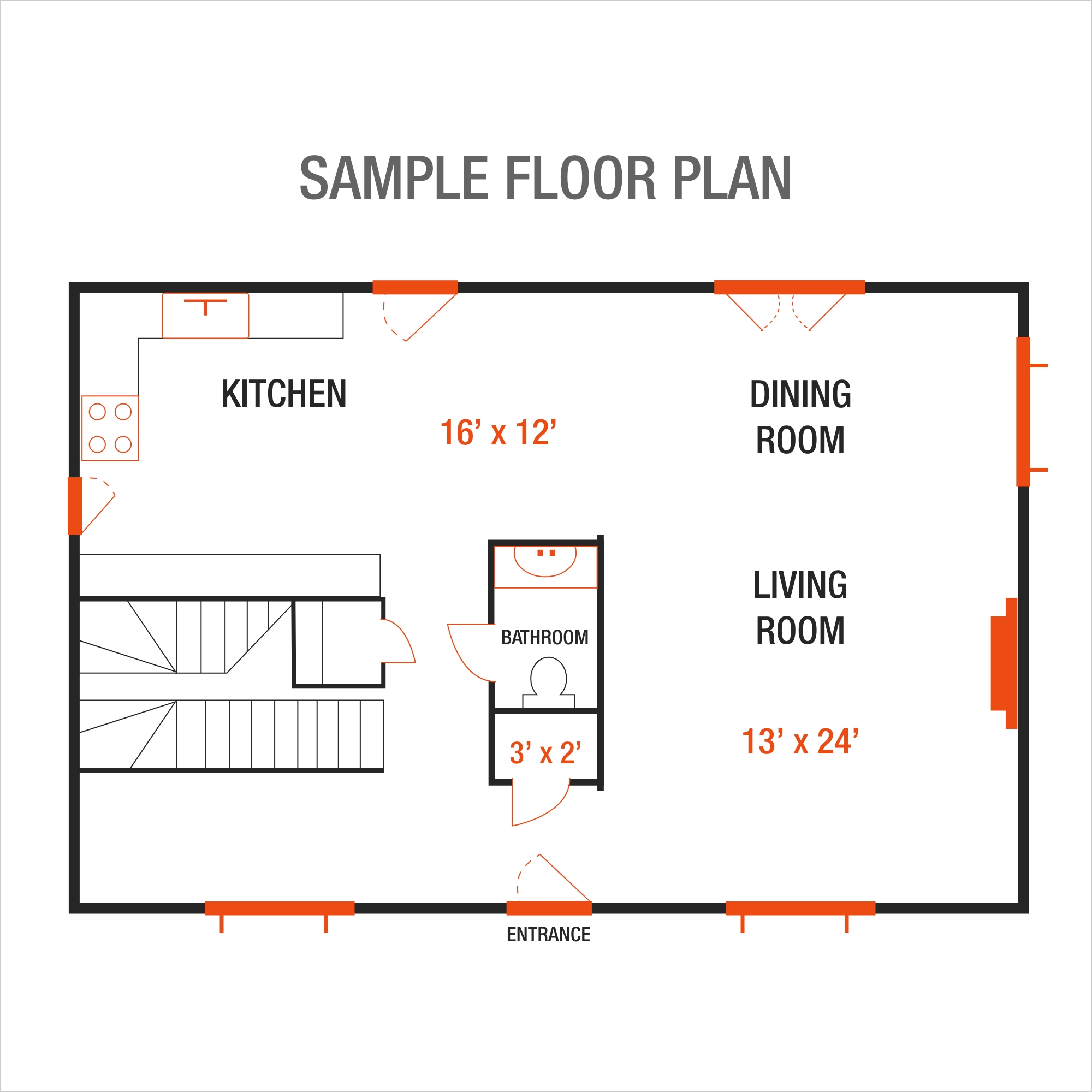

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Annual property tax is a tax that you pay to your county, typically in two installments each year.

Terms explained

Eligible active duty or retired service members, or their spouses, might qualify for down payment–free mortgages from the U.S. These loans have competitive mortgage rates, and they don't require PMI, even if you put less than 20 percent down. Plus, there is no limit on the amount you can borrow if you’re a first-time homebuyer with full entitlement. You’ll need to also consider how the VA funding fee will add to the cost of your loan. The major part of your mortgage payment is the principal and the interest. The principal is the amount you borrowed, while the interest is the sum you pay the lender for borrowing it.

Conventional loan (conforming loan)

The mortgage interest rate is the amount charged by a lender in exchange for loaning money to a buyer. It is expressed as a yearly percentage of the total loan amount but is calculated into the monthly mortgage payment. Home prices have been on a rollercoaster ride in recent years and are still very high, as are mortgage rates. It’s enough to make you wonder whether now is even a good time to buy a house. It’s important to focus on your personal situation rather than thinking about the overall real estate market.

How does credit score impact affordability?

Private mortgage insurance (PMI) is required for borrowers of conventional loans with a down payment of less than 20%.PMI typically costs between .05% to 1% of the entire loan amount. Although PMI raises your monthly payment, it may allow you to purchase a home sooner, which means you can begin earning equity. It’s important to speak to your lender about the terms of your PMI before making a final decision. And don’t forget you’d also need to pay a down payment and closing costs upfront, while keeping enough leftover to cover regular maintenance, upkeep and any emergency repairs that may arise. The Federal Housing Administration (FHA) is an agency of the U.S. government. An FHA loan is a mortgage loan that is issued by banks and other commercial lenders but guaranteed by the FHA against a borrower’s default.

What factors help determine 'how much house can I afford?'

How Much Money Do You Need To Buy A House In 2023? - Forbes

How Much Money Do You Need To Buy A House In 2023?.

Posted: Tue, 05 Sep 2023 07:00:00 GMT [source]

Use our mortgage income calculator to examine different scenarios. Before you start looking at real estate and shopping around for the right lender, it’s important to take these steps to improve your chances of becoming a homeowner without breaking the bank. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate.

Find Affordable Mortgage Options

Your lender also might collect an extra amount every month to put into escrow, money that the lender (or servicer) then typically pays directly to the local property tax collector and to your insurance carrier. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. APR (%) is a number designed to help you evaluate the total cost of a mortgage.

Sample loan programs

Results in no way indicate approval or financing of a mortgage loan. Contact a mortgage lender to understand your personalized financing options. Here are a few documents you should gather to help you understand your financial situation and how much house you can afford. This information will also be required when you apply for a pre-approved home loan.

Additionally, interest rates offered for VA loans often turn out to be lower than those offered for conventional loans. If your down payment is less than 20 percent of your home's purchase price, you may need to pay for mortgage insurance. You can get private mortgage insurance if you have a conventional loan, not an FHA or USDA loan. Rates for PMI vary but are generally cheaper than FHA rates for borrowers with good credit.

Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point. Use the home affordability calculator to help you estimate how much home you can afford. Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans.

Down payment - The down payment is money you give to the home's seller. At least 20 percent down typically lets you avoid mortgage insurance. VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. Find out what you'd owe each month given a specific purchase price, interest rate, length of your loan, and the size of your down payment. Gross monthly income is the total amount of money you earn in a month before taxes or deductions. Adjustable-rate mortgages (ARMs) have interest rates that can change over time.