Table Of Content

Jumbo loans allow you to purchase more expensive properties but often require 20% down, which can cost more than $100,000 at closing. A conventional loan is a type of mortgage that is not insured or guaranteed by the government. For a mortgage loan, the borrower often is also referred to as the mortgagor (and the bank or lender the mortgagee).

How does the type of home loan impact affordability?

How Much House Can I Afford? Affordability Calculator - NerdWallet

How Much House Can I Afford? Affordability Calculator.

Posted: Thu, 08 Oct 2015 02:49:18 GMT [source]

Lenders will also look at your debt-to-income ratio, or DTI, to get a clear picture of how risky it is to loan you money. Simply put, the higher your debt-to-income ratio, the more the lender will doubt your ability to pay the loan back. Lenders have maximum DTIs in place that could stand in the way of getting approved for a mortgage. On conventional loans, for example, lenders usually like to see debt-to-income ratios under 36 percent. Most are willing to go up to 43 percent, and in some cases, 50 percent is the cutoff. If you want to shrink your debt-to-income ratio before applying for a mortgage — which is likely a good idea — pay off your credit cards and other recurring debts, like student loans and car payments.

Type of home loans to consider

By using the 28 percent rule, your mortgage payments should add up to no more than 28 percent of $8,333, or $2,333 per month. A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices. However, interest rates on jumbo loans are much higher because lenders don't have the assurance that Fannie or Freddie will guarantee the purchase of the loans.

How to calculate annual income for your household

If your score is 580 or higher, you could put down as little as 3.5 percent. In most areas in 2023, an FHA loan cannot exceed $472,030 for a single-family home. You’ll also need to factor in how mortgage insurance premiums — required on all FHA loans — will impact your payments. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments. Loan term (years) - This is the length of the mortgage you're considering. On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years.

How does the amount of my down payment impact how much house I can afford?

Buying A House With Friends - Bankrate.com

Buying A House With Friends.

Posted: Mon, 04 Mar 2024 08:00:00 GMT [source]

Generally, the higher the credit score you have, the lower the interest rate you’ll qualify for and improve overall what you can afford in a home. Even lowering your interest rate by half a percent can save you thousands of dollars and increase your affordability range significantly. Equally, the lower the interest rate you can get the less you’ll pay each month against your mortgage as well as over the life of the loan. Below are some hypothetical examples of how slight differences in your APR(%) can impact what you pay against your mortgage. When lenders evaluate your ability to afford a home, they take into account only your present outstanding debts.

How to improve your home affordability

This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. The Veterans Affairs Department (VA) is an agency of the U.S. government. VA loans make home ownership more possible for borrowers than it otherwise would be through conventional mortgage loans, primarily because a VA loan does not require any down payment.

There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation. List out your expenses and then add them together to get your total monthly spending. Naturally, the lower your interest rate, the lower your monthly payment will be. Want a quick way to determine how much house you can afford on a $40,000 household income?

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. At Bankrate we strive to help you make smarter financial decisions.

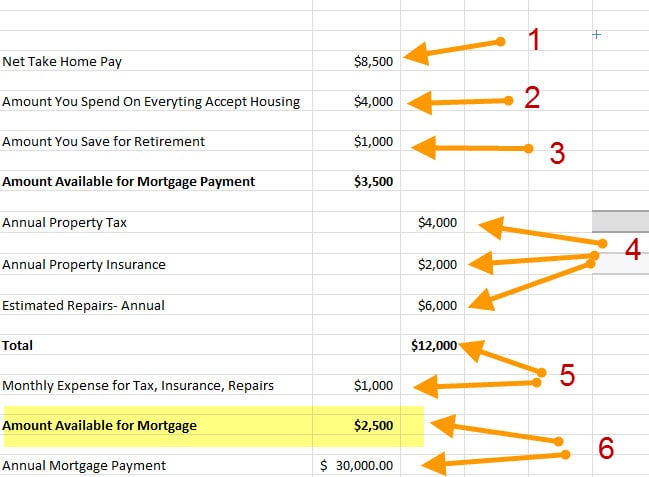

Find Affordable Mortgage Options

That means your mortgage payment should be a maximum of $1,120 (28 percent of $4,000), and your other debts should add up to no more than $1,440 each month (36 percent of $4,000). You’ll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement. Most home loans require a 20% down payment, but Federal Housing Administration (FHA) loans only require a minimum of 3.5%. This type of loan opens the door for many potential homeowners that do not have the savings for a substantial down payment.

Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. Most home loans require at least 3% of the price of the home as a down payment. Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment. A 20% down payment also allows you to avoid paying private mortgage insurance on your loan. You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for.

Down payment & closing costsNerdWallet's ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed (such as cash back, travel or balance transfer) and the card's rates, fees, rewards and other features. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. That’s a big deal, because mortgages backed by the Department of Veterans Affairs typically don’t require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors. Loan start date - Select the month, day and year when your mortgage payments will start.

The APR is calculated according to federal requirements and is required by law to be stated in all home mortgage estimates. This allows you to better compare how much mortgage you can afford from different lenders and to see which is the right one for you. This loan type is specifically designed for families looking to buy homes in rural areas. Similar to the FHA loan, this home loan lets lower-income families become homeowners. The loan does not require a down payment, but you will have to get private mortgage insurance.

While we adhere to stricteditorial integrity,this post may contain references to products from our partners. In addition, the calculator allows you to input extra payments (under the “Amortization” tab). This can help you decide whether to prepay your mortgage and by how much.

Loans, grants, and gifts are three ways to supplement your savings for a down payment. A lender is a financial institution that provides a loan directly to you. Our partners cannot pay us to guarantee favorable reviews of their products or services. We'll help you estimate how much you can afford to spend on a home. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

No comments:

Post a Comment