Table Of Content

You could also consider a rent-to-own arrangement, where you rent a home with the option to buy it later. During the rental period, a portion of your payments will cover the rent while the rest will be put toward a down payment on the house. This can help you avoid having to come up with a large lump sum to put down—though keep in mind that it’s best to get preapproved for a mortgage beforehand to make sure the home is in your budget. Sometimes you will still need to fund part of the down payment yourself, but you might only need to come up with 1% or 2% of the purchase price instead of 3% or more. If you got a mortgage for 100% of the purchase price, your down payment would be 0%.

Places with the lowest median down payments (in dollars)

This assumes you keep the same loan at the same rate and never refinance. But let's say you have enough money in the bank to make a 30% down payment, leaving you to put down $120,000 and borrow $280,000. At that same interest rate, your monthly principal and interest payment will be $1,828. That means you're spending $262 less per month, or $3,144 less per year.

financing a homePromissory note in real estate, explained

Buyer’s brokers commonly field questions about how much should be saved up for a down payment when buying a home in California, and the answers differ for all buyers. There are a number of government programs available to prospective homebuyers who are struggling to come up with a down payment. These down payment assistance programs may offer help in the form of forgivable grants and low-cost loans. The programs are designed to encourage homeownership and are generally restricted to first-time homebuyers.

Chase for Business

In the second quarter of 2023, Louisiana home buyers made the lowest average down payment of 9.2% at $6,729, while Washington, D.C. Has the highest down payment percentage amount at 20.4%, with a $100,800 median down payment due to the area’s expensive housing market. Now, let’s say you put down 20% on the $300,000 home, which is $60,000. With a 20% down payment, your total loan amount would lower to $240,000. Using the same 7% interest rate, your monthly mortgage payment would be around $1,596 – excluding taxes or insurance costs.

Best Mortgage Lenders For Low And No Down Payments Of 2024 - Forbes

Best Mortgage Lenders For Low And No Down Payments Of 2024.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

The changes could see people being provided with either one-off grants for specific costs such as home adaptation, or being directed to "alternative means of support" rather than financial support. The biggest impact of rising interest rates has been in southern England where house prices are higher. According to survey results released Tuesday by real estate company Redfin, 38% of homeowners say they probably or definitely could not afford to buy the homes they live in at today's prices. A majority of homeowners surveyed have owned their homes for at least five years.

Why Down Payment Is Home Buyers' Biggest Challenge - NerdWallet

Why Down Payment Is Home Buyers' Biggest Challenge.

Posted: Fri, 23 Feb 2024 08:00:00 GMT [source]

The highlight bullet points above show the average down payment on a home in California based on the current median home price. We’ve included three different investment thresholds, including the minimum down payment amount (3%) that’s required for a conventional home loan. Most homebuyers getting a mortgage have to pay a portion of the property’s purchase price upfront.

Applicants usually still need to have decent credit and documented income. Ideally buyers would be able to put down at least 20% of the home price to avoid paying private mortgage insurance, but it’s not a requirement. With the median home price in 2023 at over $425,000, the average homebuyer would need $85,000 just for the down payment. Having more set aside for a down payment makes borrowers more attractive to mortgage lenders, so it can earn you a lower interest rate and fewer fees. If you have 20% available, you can likely avoid mortgage insurance. A bigger down payment also means you'll own more equity in the home right away.

Cost of mortgage insurance premium passed through to client effective January 2, 2024. Offer valid only for home buyers when qualifying income is less than or equal to 80% area median income based on county where property is located. Not available with any other discounts or promotions and cannot be retroactively applied to previously closed loans or loans that have a locked rate. Rocket Mortgage reserves the right to cancel/modify this offer at any time. Bankrate.com is an independent, advertising-supported publisher and comparison service.

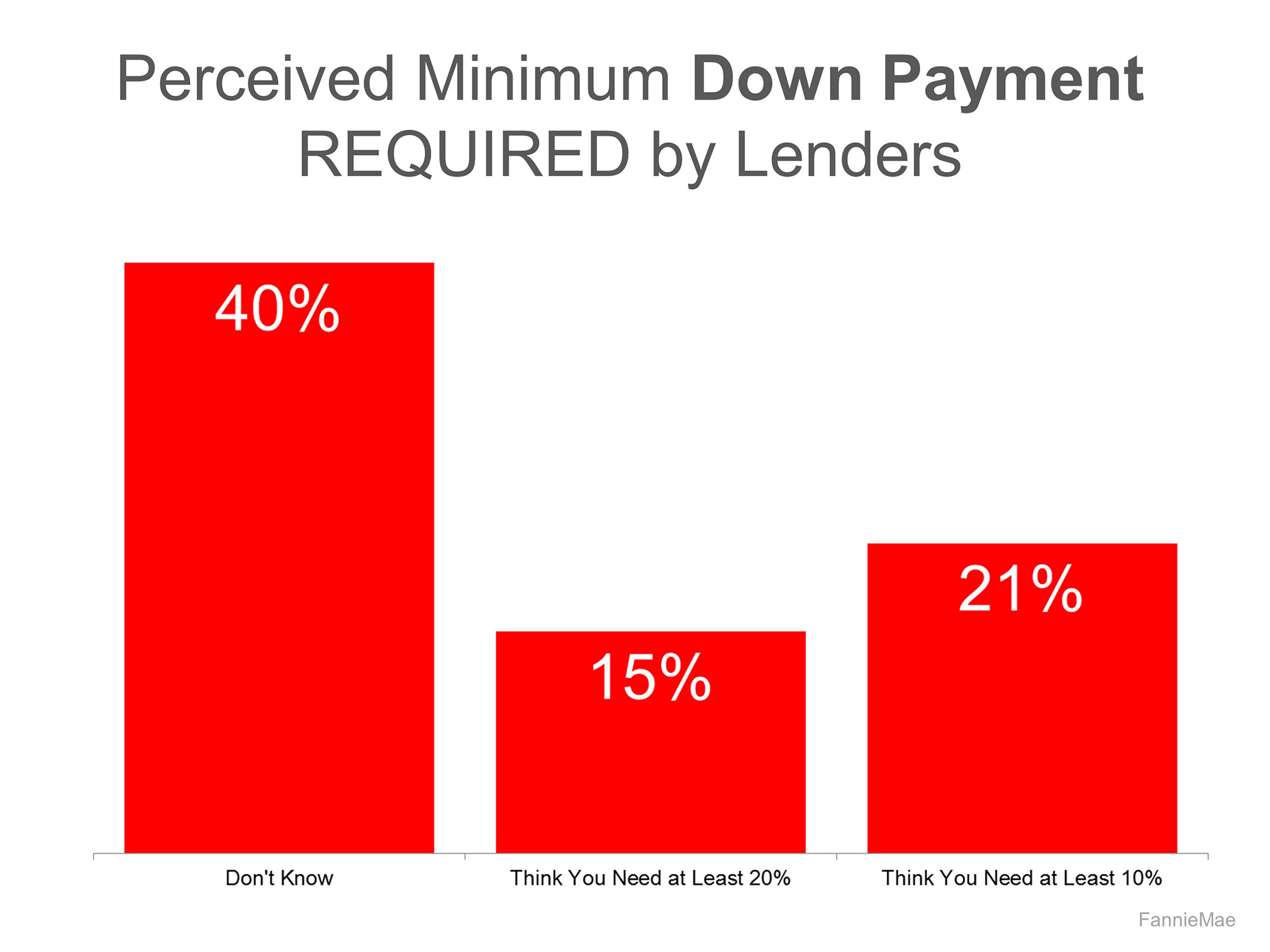

Mortgage Rates by State

Many believe they need a 20% down payment to buy a house, but is that true? Let’s look at the actual data surrounding first-time home buyers and down payments. The minimum down payment will largely depend on the type of loan you choose for your primary or secondary residence or investment property. You likely won’t put any money down if you qualify for a USDA or VA loan. Home sellers often prefer to work with buyers who make at least a 20% down payment. A bigger down payment is a strong signal that your finances are in order, so you may have an easier time getting a mortgage.

At the same time, you don’t want your down payment to be so large that it leaves you with too little savings. Most homebuyers also want enough cash after closing to do things like buy new furniture or paint the walls. Generally speaking, older buyers make larger down payments than younger buyers.

With an ARM, the initial rate is often lower than a fixed-rate loan. A down payment is the portion of the home price the borrower pays upfront. If you qualify for a USDA or VA loan, you generally won’t have to worry about a down payment. One rule of thumb — the 28% rule — says your housing payment should be no more than 28% of your gross pay.

Miranda is dedicated to advancing financial literacy and empowering individuals to achieve their financial and homeownership goals. She graduated from Wayne State University where she studied PR Writing, Film Production, and Film Editing. Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards.

Saving for a down payment is a common homeownership hurdle to clear. But depending on your location and level of financial need, you may have down payment assistance options to explore. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover. Financial markets currently see two rate cuts by the Bank of England this year.

That may not seem like much, but it doesn’t paint the entire picture. In our second example, with a 20% down payment, you would pay interest on a $240,000 loan rather than the $270,000 loan in our first example. An FHA loan is ideal for first-time buyers with less-than-perfect credit scores and offers down payments as low as 3.5%. Unlike conventional mortgages, mortgage insurance includes both an upfront amount and a monthly premium. The down payment requirements for a conventional loan on a primary residence vary depending on the lender, the borrower and the property type. For example, first-time homebuyers and buyers with low to moderate incomes could qualify for a fixed-rate conventional loan with a 3 percent down payment.

No comments:

Post a Comment